Pictured: Tomy Han, Partner at Volition Capital

There is a myriad of efficiency ratios for SaaS business (i.e. CAC payback period, LTV:CAC, GRR, NRR, etc.) in the market, often based on theoretical assumptions. They focus on an accrual-based world where payments inflow and expenses are paid out on a mechanical basis. While these are helpful metrics in understanding the unit economics of a business, they ignore the reality most growth-stage businesses face: a balance sheet with a finite amount of cash.

A topic that does not get enough attention in our opinion is the cash conversion cycle of a business. Especially early in a SaaS business’ lifecycle, maximizing cash inflow and minimizing (or delaying) cash outflow drives the real pace of growth and progress of a business. No matter how wonderful one’s LTV:CAC ratio is, a company needs real dollars on its balance sheet to be able to invest in growth and pay salaries. And while seeking external capital (and hence dilution) is always an option to fund growth and supercharge the balance sheet, the best source of funding still remains dilution-free customer dollars.

Finally, there are two components to shareholder value creation: 1) maximizing equity value and 2) minimizing dilution. And we believe a key lever to increasing #2 is payment terms. Lets take a closer look.

Exercise

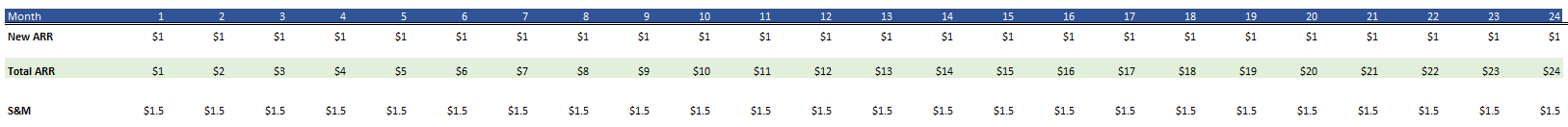

Consider a theoretical SaaS business (Company A) with the dynamics below:

- Adds $1M of new ARR per month.

- 100% Gross Margins

- 100% Revenue Retention

- 5-year CAC payback period

- $1.5M S&M expense, paid monthly

Here is what Company A’s financial projections would look like over a 24-month period:

Company A would achieve $24M ARR on $36M in cumulative S&M spend over a 24-month period. Under these assumptions, how much capital does this company need to raise? This depends on the company’s payment terms with its customers.

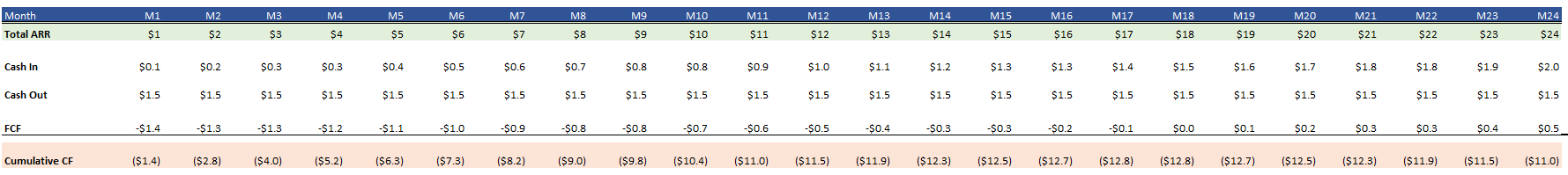

Monthly vs. Annual Payment Model

Let’s start off by taking a closer look at a monthly payment model. The chart below projects Total ARR, the cash in/out dynamics of the business, free cash flow (FCF) and cumulative cash flow (CFC) over 24 months:

If Company A were to charge customers on a monthly basis, the cash low point is on M18 at a cumulative ($12.8M) deficit at $18M in ARR. In other words, under a monthly payment model, the company would need a total of $12.8M of balance sheet funding to be able to execute on its growth and eventually turn the corner on profitability.

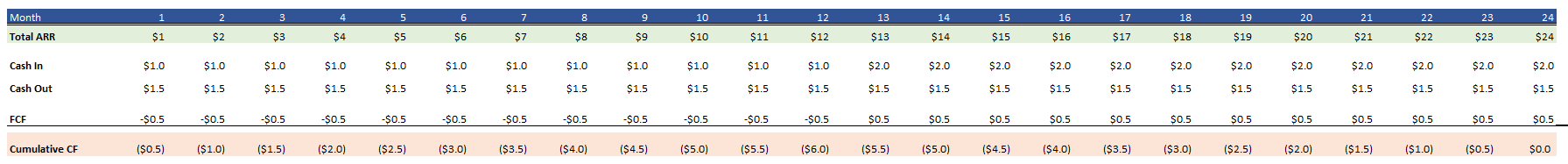

How does this compare to a model with the same assumptions but with an annual upfront payment model?

The chart below projects an annual upfront payment model for Company A:

If Company A were to charge annually upfront, the cash low point is in M12 at a ($6.0M) deficit and at $12M in ARR. The Company would need a total of $6M on the balance sheet for this business to achieve profitability.

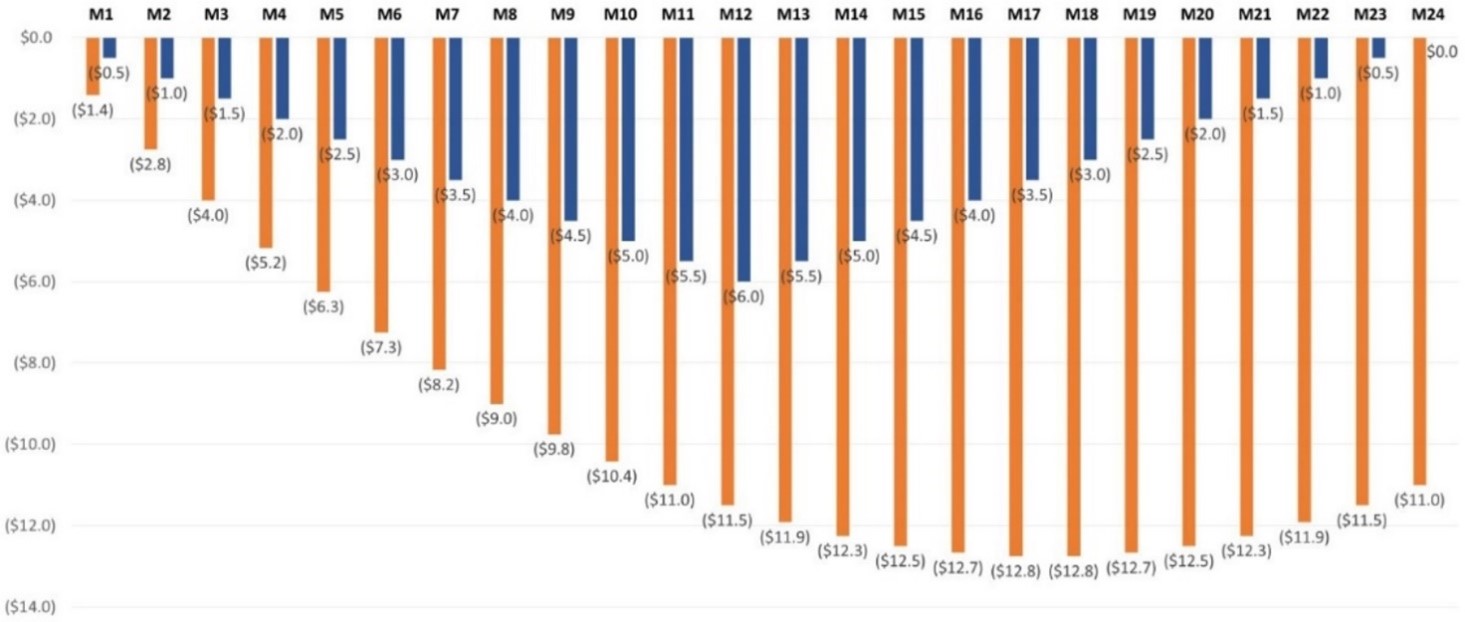

Net, the monthly payments model would require more than 2x the capital to achieve the same scale and growth rate, under the same expense base, compared to an annual upfront model. Below is a month-by-month comparison on the cumulative cash burn of Company A based on a monthly vs. annual upfront payment model.

Quantifying Shareholder Dilution

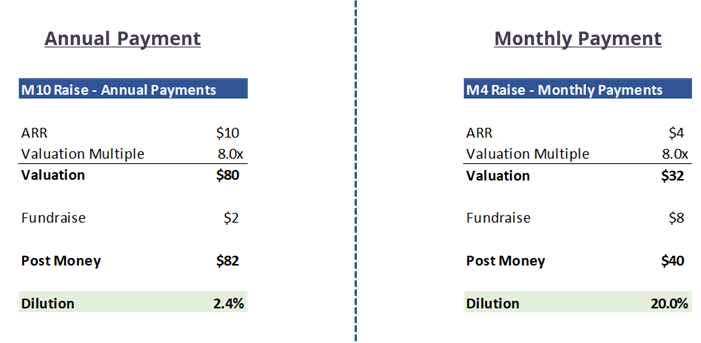

Let’s assume Company A started with $5M of capital on its balance sheet from founders. Under this assumption, a monthly payment model will require a fundraise of $8M1 in M4. In an annual upfront payment model, Company A will require a fundraise of $2M2 in M10.

Additionally, a monthly payments model not only needs to raise more dollars, but it will need to do so earlier at a lower ARR base. To quantify the impact of this dilution, if we were to apply an 8x ARR multiple, roughly the 75th percentile of SaaS multiples from the Volition’s Rule 40 Index as of May 2024, below is the amount of dilution existing shareholders would need to take to execute on the plan originally laid out:

The difference in dilution becomes a staggering ~18%, which upon exit at different stages in ARR, has meaningful differences in proceeds to shareholders:

- $24M ARR x 8x Multiple x 0.18 = $35M in proceeds

- $36M ARR x 8x Multiple x 0.18 = $52M in proceeds

While there are many other variables for consideration in this analysis, including the use of debt, different valuation multiples that need to be adjusted for scale, etc. the takeaway is clear:

Payment terms can make a meaningful impact in protecting and creating shareholder value.

At Volition, we have seen many businesses, especially those selling to large enterprises or governments, collect multi-year payments upfront. The effect of those payments further magnify the impact payments and deferred revenue can have on high-growth startups. While a shift from monthly to quarterly or annual payments is not always possible due to variables such as ICP (ideal customer profile) and type of product, this is a topic that deserves more attention from management teams and boards.

1 – Added extra $0.2M of balance sheet capital

2 – Added extra $1M of balance sheet capital

Did you enjoy Tomy Han’s piece on “The Equity Impact of Payment Terms in SaaS Businesses?” Make sure to check out his page to see more of his thought pieces.

Disclaimer

This information is provided for general informational purposes only. Under no circumstances should this information be used in connection with or be considered an offer, solicitation of an offer, or a recommendation to purchase or sell, any securities, nor does any such material constitute investment, legal, accounting or tax advice or an endorsement with respect to any investment strategy or company.

This information may include forward-looking statements. Volition Capital LLC (“Volition,” “we,” or “us”) can give no assurance that such expectations will prove to be correct. Past performance is not indicative of any specific investment or future results. Any specific companies listed or discussed are for illustrative purposes only, and do not represent any or all companies purchased, sold or recommended or an investment recommendation or offer to provide investment advisory services.

Views regarding the economy, securities markets or other specialized areas are not guaranteed to be accurate. Volition does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any of this information, and Volition takes no responsibility therefor.

Volition has no obligation to update, modify or amend any such information or to notify you in the event that any information, opinion, projection, forecast or estimate changes or subsequently becomes inaccurate. The views expressed herein are those of the individuals quoted or named and are not the views of Volition Capital LLC or its affiliates.

This information is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by Volition.