Healthcare IT: What is Revenue Cycle Management?

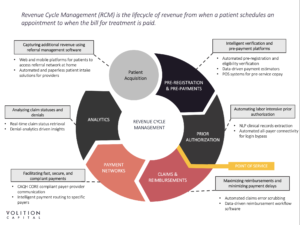

Simply put, Revenue Cycle Management (RCM) relates to everything that has to do with making money in healthcare. More granularly, RCM is the process that healthcare facilities use to track important financial and patient data – from appointment scheduling to billing. Crucial to this process, and the reason it is called a cycle, is how RCM billing software interfaces between patients, doctors, administrators, and insurance companies. It acts as a data liaison capturing billable charges, initiating claims, and concluding service reviews, all within the complicated procedural web of the healthcare industry.

The strain that this complicated cycle puts on healthcare providers to manage this data in-house has led to a burgeoning field of third-party service providers and software companies filling the gap. There is a tremendous opportunity for these vendors. The RCM market was estimated at ~$23.6B globally in 2016, but it is projected to grow at a 12% CAGR to ~$65.2B by 2025. (1) Providers, with significant lost profits at stake, increasingly look to outsource RCM responsibilities. The percentage of providers intending to outsource RCM functions grew from 59% in 2016 to 84% in 2019. (2)

Why Such Growth in RCM Functions?

In short, it’s getting harder for healthcare providers to get paid. For one, the burden of payment has been increasingly shifted toward patients, which further complicates the ability to collect payments. Over 50% of covered workers in the U.S. now have a deductible over $1,000. (3) This comes as costs within the healthcare industry have risen dramatically across the board, now representing 18% of U.S. GDP. (4) Patients are not in a financial position to handle these rising out of pocket medical bills, as 62% of patients don’t have the money to cover a $1,000 ER visit. (5) Rising costs and a shift in the burden of payment to patients creates a situation in which many hospitals cannot recover payments, and therefore carry large sums of bad debt.

Into this mix comes government regulation. Having gone into effect in October 2015, the ICD-10, a clinical cataloging system that codes for diseases, treatments, and billing outcomes, has drastically increased the number of billing codes to over 155,000. (6) This makes the process of denoting billing procedures much more complicated and time-consuming. It also makes training a much more rigorous and costly endeavor. Even more importantly, the shift to ICD-10 causes hospitals to have expensive claim denials due to frequent errors in manual code entry and incorrect coding.

How Can RCM Vendors Help?

The primary opportunities for RCM software vendors and tech-enabled service providers are threefold:

- To help providers collect more from patients upfront

- Manage billing complexity and reduce coding errors

- Drive higher collection rates for bad debt

The emergence of new technology has enabled software and tech-enabled RCM vendors to better engage with patients and alleviate many of the problems providers are facing while fulfilling the three challenges outlined above.

These vendors can provide apps for higher patient engagement and mobile payments, increasing the likelihood of collection upfront. They also offer advanced APIs and Electronic Health Record (EHR) integrations, which give more coordinated care and standardized patient data collection across hospital systems and collaborative care teams. They can utilize Robotic Process Automation (RPA) and Natural Language Processing (NLP) to quickly automate patient data extraction, minimizing the staff necessary to process claims. Finally, they make use of predictive analytics to measure a patient’s propensity to pay, helping to prioritize collections efforts while also proactively identifying and correcting coding errors that could result in denial of claims.

RCM & Healthcare IT: Conclusion

We at Volition Capital see software and tech-enabled RCM vendors as a strong bet based on projections of future growth, the rising cost of healthcare, and the pressures on providers to maximize efficiency. More than one-third of all hospitals now carry bad debt over $10 million of which only 12-15% is projected to be recoverable. (7) Leveraging technology, RCM vendors can greatly increase collections, making the healthcare industry a more efficient place.

Q&A Video

Citations:

- Cascadia Capital, 2019

- Black Book Study, 2016

- Cascadia Capital, 2019

- Peter G. Peterson Foundation

- Cascadia Capital

- Nachimson Advisors, 2015

- Transunion, 2019