The Rule of 40 has become an increasingly popular metric to evaluate SaaS companies at scale. The basic premise is that companies generally command a premium valuation if their year-over-year revenue growth rate + profitability margin = 40% or higher.

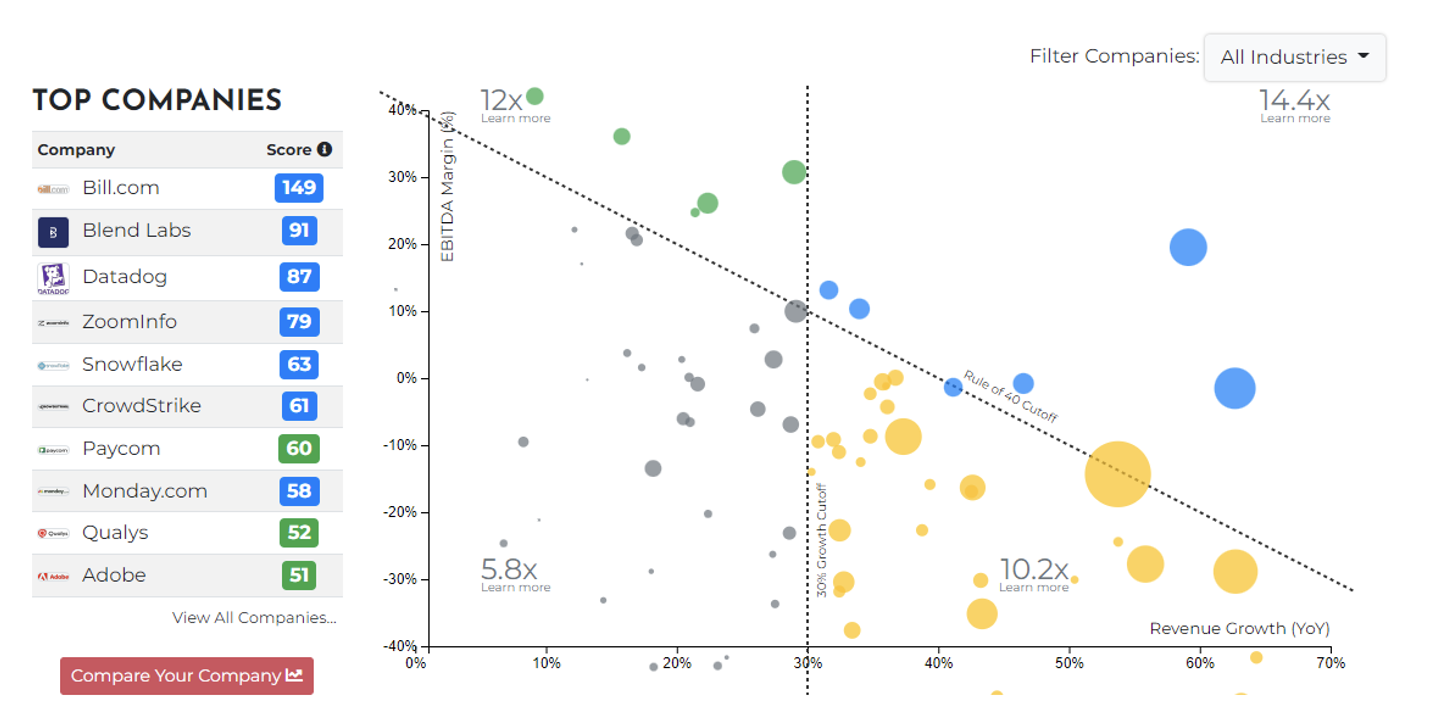

In our analysis of the Rule of 40 earlier this week, we looked at 80+ publicly traded SaaS companies using the Volition Capital Rule of 40 Index. We found that The Rule of 40 is a generally useful metric at a high level, as the 19% of companies that beat The Rule of 40 did command higher valuations than those that didn’t. However, on an individual level, there are still exceptions to The Rule of 40. This indicates that the Rule of 40 is a surface metric that can provide base-level insights that should then be investigated further.

The purpose of this article is to explore the limits of The Rule of 40, highlight a high-profile example of a good company that doesn’t meet The Rule of 40 threshold, and explain why it can sometimes be beneficial to drop below The Rule of 40 as a private company in pursuit of longer-term growth.

Limits of The Rule of 40

As metrics go, The Rule of 40 is relatively simple. It really only looks at two inputs: revenue growth rate and profitability margin. This means that other relevant metrics or factors that can provide important context are not considered.

For example, The Rule of 40 ignores retention, an incredibly relevant metric for SaaS companies. It’s also just a snapshot in time, and because it’s a percentage metric rather than an absolute metric, it isn’t really useful until a company has reached a certain degree of maturity. Growth at scale is significantly more impressive than early-stage growth when the customer base is relatively small.

Furthermore, if your company has been capital inefficient, by the time you reach The Rule of 40 consistently, you might not own much of the company. In this case, even if you command a premium valuation, you won’t see much of that capital.

Finally, The Rule of 40 does not speak to the value of your specific market. You could beat The Rule of 40 in a sector that investors do not care about, and it would hardly move the needle in terms of valuation.

A Notable Exception to the Rule of 40

If you look at our Rule of 40 Index of 80+ publicly traded SaaS companies, you’ll see several companies with large bubble sizes yet fall below the diagonal line. This means that they command higher EV/R multiples but do not beat The Rule of 40. One prominent example is MongoDB, a subscription database as a service platform. In Fiscal Q4 ’22 (3 months ending January 31, 2022), MongoDB experienced nearly 60% growth, but its EBITDA Margin was nearly -30%, falling short of The Rule of 40. Nevertheless, it was one of the highest valued companies on the list, and its stock price has continued to soar in recent months.

As we begin to investigate the reasons for this high valuation, the picture becomes clearer. Situated at the confluence of three wildly important tech trends — cloud, digital transformation, and application development — MongoDB is in a massive and growing market.

While the markets have previously rewarded companies that pursue growth over companies that pursue profitability, the data suggests a shift toward balancing growth and profitability. The EV/Revenue multiples for companies in the top quadrants on average exceeds those in the bottom quadrants given the ability to grow top line revenue while maintaining profitability.

While analysts at SeekingAlpha have consistently viewed MongoDB’s stock as overpriced, they do cede that the company’s fundamentals are strong, and it has overperformed relative to predictions. They also note that a premium valuation is warranted given the secular tailwinds and MongoDB’s ability to accelerate ARR growth at its current scale. While the Company generated negative EBITDA margins throughout FY 2022, the business began to operate near cash flow breakeven for the year. Given its scale and the $70B+ market opportunity, MongoDB is reaching an inflection point in FY 2023: invest further in driving top line growth, or focus on profitability.

The Rule of 40: More What You’d Call a Guideline than an Actual Rule

We previously compared the Rule of 40 to the story of the tortoise and the hare; sometimes it pays to be fast and chase growth, but other times it pays to be slow and steady and chase profitability. Another reference that seems apt comes from Pirates of the Carribean. When asked about the Pirate’s Code, Captain Barbosa indicates that the Code “is more what you’d call guidelines than actual rules.”

The Rule of 40 is very much the same. It gives you a limited snapshot in time and acts as a valuation guideline. Companies should evaluate their specific market and capital availability to determine if sacrificing short term profitability in pursuit of responsible growth is the correct decision.

In many cases, investing in R&D and new products can have a huge payoff in the long run. You might dip below The Rule of 40 threshold, but, as we’ve seen with MongoDB, this doesn’t make you a bad company. In fact, investors might have significant appetite for negative EBITDA margins in the right circumstances. If you have a huge market and captive and happy customers, it might make sense for you to make investments in your company that take you below The Rule of 40 but help your valuation in the long run.

Meet the Authors:

SEAN CANTWELL

Managing Partner

Sean Cantwell is a managing partner and member of the founding team at Volition Capital. He focuses primarily on companies in the Software and Tech-Enabled Services sectors.

Connect with Sean:

Pete Keenan

AccountING MANAGER

Pete joined the Volition Capital team in the Fall of 2019 to support the investment team with fund administration, financial modeling, and legal document review.

Connect with Pete: