By Jim Ferry

COVID-19 has resulted in 10 years of ecommerce growth in just a few months. The rate of digital adoption has accelerated across all verticals, although insurance is still a laggard with just 35% user digital adoption compared to banking digital adoption of 73%.

Legacy insurance carriers have been slow to adopt new technologies due to being content with the status quo and a lack of modern infrastructure. At their core, legacy carriers are traditionally risk averse and are reluctant to test new technologies with fears of data breaches and changing historical ways. A lack of competition driving change has led to carriers being complacent in their ways. Despite Lemonade’s recent success, its net written premiums are still 0.2% of State Farms and not relevant to large carriers.

This lack of carrier innovation has resulted in a poor customer experience. 56%+ of consumers ages 18-44 believe insurance carriers need to improve the website and smart phone experience, as well as the claims processing technology. Across every insurance category, 60%+ of consumers find the insurance claims process to be somewhat complex or complex. There is also a value gap and lack of trust as 43% of consumers believe that 50% or less of claims are successfully paid out, despite the actual figure being above 90%.

A New Digital Customer is Emerging

Millennials are driving the largest percentage of online insurance purchases, with only 4% of millennials believing their insurance policy is worth the cost, which presents an opportunity to create more value through new products. 58% of millennials want help understanding their coverage and how their plan works, while 50% want to know what to expect if filing a claim, displaying a basic lack of understanding of insurance products that can be solved by simplifying the policy terms through transparency. This lack of legacy carrier innovation has created an opportunity for digital insurance startups to address this audience.

Digital Insurance is Filling the Gap

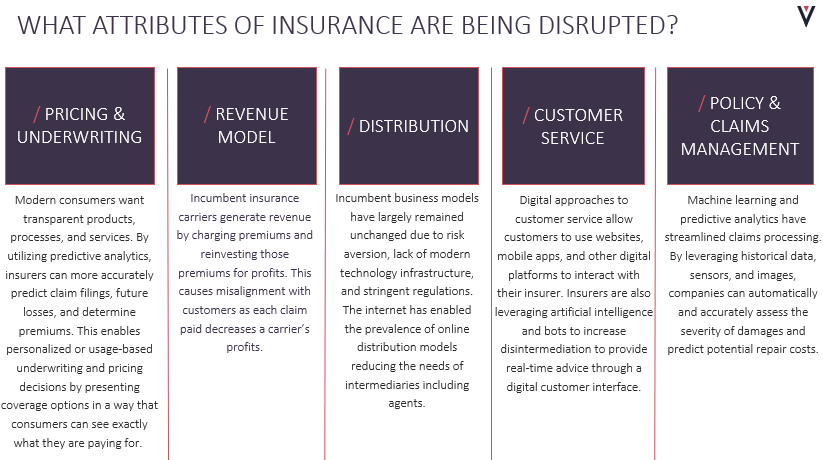

Price and claims experience are mentioned the most by customers to determine if they are a detractor or promoter for insurance carriers. Incumbent carriers have attempted to create new digital brands to address this issue, although legacy technology systems and the status quo of large agent workforces have caused limited success. Given these failed attempts at creating digital brands, insurance carriers have started to create their own corporate venture capital arms to invest in startups with a digital focus.

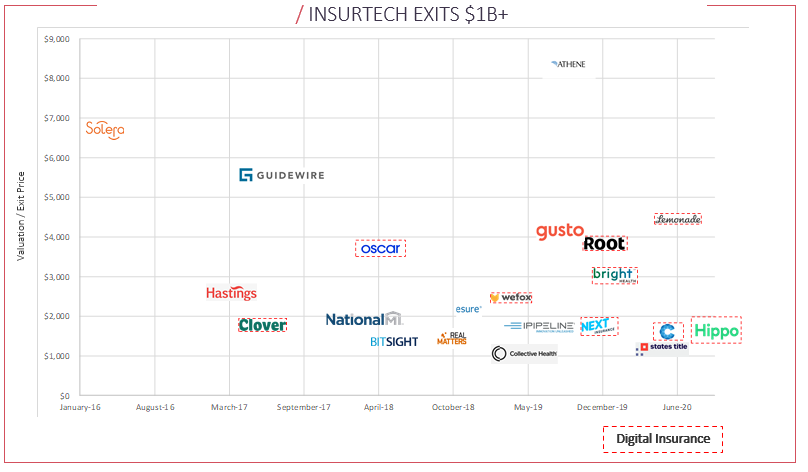

The first wave of InsurTech exits of $1B+ enabled legacy carriers to update their infrastructure or back office, while the new wave of InsurTech is focused on owning the end customer and/or digital distribution.

Digital Insurance Distribution Models

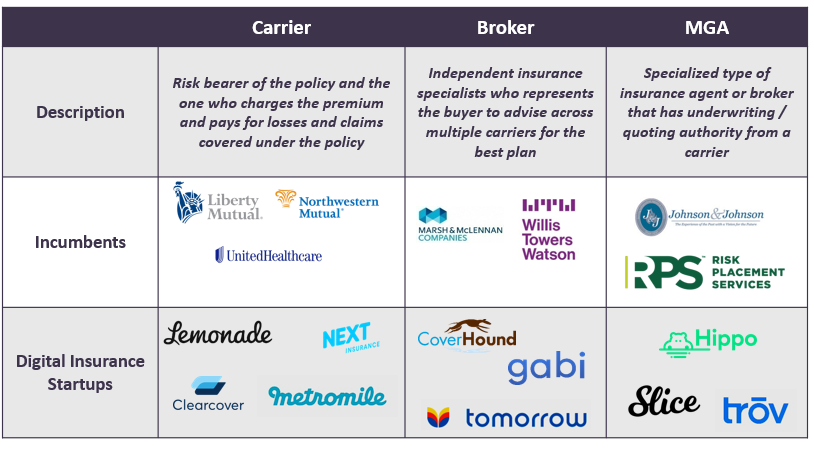

There are three primary online insurance distribution models including carriers, brokers, and Managing General Agents (MGAs):

- Full Stack Carrier: The traditional insurance carrier model generates revenue by charging premiums and reinvesting those premiums, with each claim paid decreasing a carrier’s profits. This causes misalignment with the customer and carrier, leading to a poor user experience. In addition, the incumbents have high overhead costs from human capital, including the agent workforce, that can be an unnecessary step in the value chain. In contrast, many digital carriers take a fixed management fee of premiums as their revenue and pool the remaining funds to pay claims. This model aligns the digital carrier and customer as paying claims does not impact revenue or profits. The use of modern technology for underwriting and claims processing allows digital carriers to also eliminate overhead through online distribution and servicing which can lead to lower premiums.

- Digital Brokers: The first wave of digital insurance brokers provided price comparison websites. The low barriers to entry have commoditized this space with many companies competing on AdWords with similar products. To compete in this environment, a new startup will most likely need to raise a significant amount of capital to build a brand to drive organic traffic and make the unit economics profitable. The next generation of digital brokers must provide unique value props such as new customer data inputs to lower customer premiums and build a competitive moat.

- Managing General Agents (MGAs): The attractiveness of the MGA model is that it allows startups to build products and underwrite policies without the need for a balance sheet to hold the risk, while providing a better customer experience. Depending on carrier relationship, an MGA’s functions can include binding coverage, underwriting and pricing, and settling claims. Specialty MGAs have deep categorical knowledge and data to understand the risk and exposures to a policy that a traditional carrier may not have the expertise to underwrite. A quasi-carrier MGA may sell a similar product to the risk bearing carrier, but with a modern infrastructure allowing for digital distribution and servicing. Startups leverage the low cost of capital to start as an MGA. Once an MGA has built a brand and enough scale, the MGA can move up the value chain to become a full stack insurer to own the end customer and more of the economics.

Other Digital Insurance Models

Cost Sharing: In a similar model to next gen digital carriers, members pool money into a fund that is used to pay for their needs while the managing entity takes a percentage management fee of premiums. Cost sharing is technically not insurance because there is no transfer of risk, so the cost sharing community does not guarantee a payout. This requires the customer to be better consumers and comparison shop to decrease the overall price for the sharing community. The benefit for the consumer is lower costs and faster claims payouts.

Parametric Insurance: Traditional indemnity insurance pays claims based on the cost of the loss incurred, as decided by a loss adjuster. In contrast, parametric insurance pays a fixed amount when a predefined event occurs, allowing for faster claims payments and lower claims adjustment costs. Because a parametric policy covers the impacts of an event and not just losses sustained to an asset, the proceeds of the policy can be used flexibly to cover any expense associated with the triggering event, which may otherwise be excluded from traditional insurance policies. While this specialty insurance was created for catastrophes, the prevalence of IoT and new technology allows the model to spread to more use cases.

Tracing the Future of Digital Insurance

With ~$1.2+ trillion in US net written premiums, the insurance market is large enough to have multiple winners across a wide range of insurance types. Volition provides a unique perspective to digital insurance companies given our experience investing in InsurTech companies serving large carriers (iPipeline, RedBrick Health, and Bond-Pro), D2C investments (Chewy and Burst), and marketplace / network investments (Globaltranz, Prosper, and RTS). We are excited to share this knowledge with founders of digital insurance startups looking for a partner to help them achieve their aspirations.