Over the past several years we have witnessed a fundamental shift in sustainability’s position within business and investing – it is no longer a nice-to-have but a non-negotiable. Consumers, shareholders, and governments are exercising powers that act as economic incentive to implement sustainable business models. This comes in the form of increased customer acquisition, greater investor attention, and avoiding government penalties… and signals are clear this will not change. The European Green Deal has set the EU on a transformative journey to carbon-neutrality in the next few decades, and global corporate leaders such as Amazon have pledged to deliver on sustainable operations, packaging, and net-zero carbon emissions by 2040. Meanwhile, surveys show 64% of Americans believe protecting the environment should be a top public policy priority, rivaling prioritizing the economy at 67%.[1]

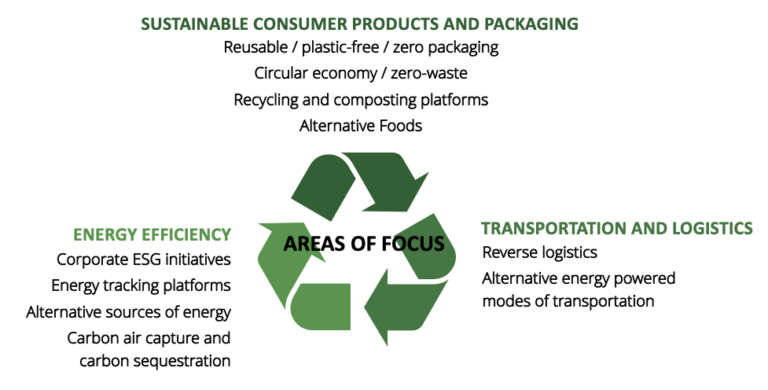

From niche just a decade ago, making businesses environmentally friendly is a core focus for management teams today. This shift has triggered rapid growth among foundational sustainability companies and presents a rare market dynamic where in many cases demand is outpacing supply as businesses across all industries race to lead their peers among the categories below, and more…

Is Sustainability Investing Niche? It Used to Be.

The state of sustainability just a decade ago was of a niche and uncertain future. Most green options were expensive and time-consuming, attracting a select group of early adopters. Solar and wind power, for example, were high ticket items with low accessibility, talk around the circular economy was minimal, and electric vehicles and carbon offsetting were still highly visionary. Viewed as a high-risk area for investment, ESG investing on the private and public level was largely kept to those funds with pure sustainability focus.

Most green options were expensive and time-consuming, attracting a select group of early adopters…

The State of the Sustainability Economy and Investor Behavior Today

Over the past several years we’ve seen sustainability go mainstream. Whether we realize it or not, “going green” has already changed our everyday routines and habits, ranging from the way we eat to the way we dress to the way we get from point A to point B. Tesla’s market cap stands at over $1 trillion as I write this (making it more valuable than the next five largest car manufacturers combined) and renewables were the cheapest source of energy globally in 2020, with the cost of large-scale solar projects falling by 85% over the past decade.[2] Businesses across every industry are publicly announcing lofty initiatives that will require rapid development throughout the green economy, from BP and Shell pledging net zero emissions by 2050 and Coca Cola pledging 50% recycled packaging content by 2030.

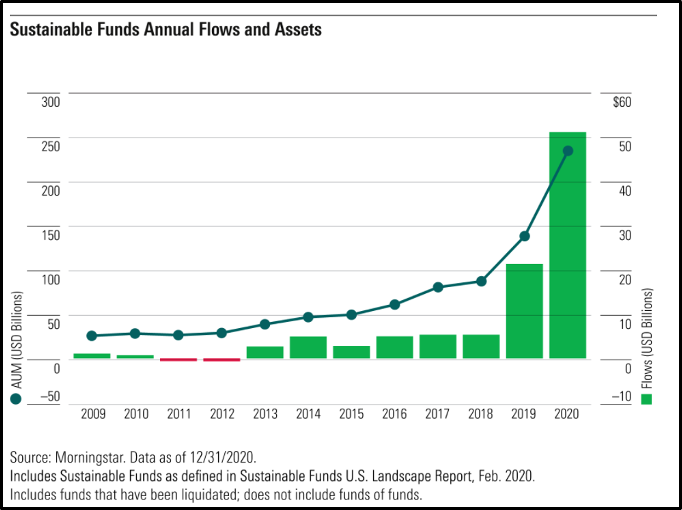

If you had any doubt that sustainable investing had entered the mainstream, just look at the money pouring into the sector. Below we see the record breaking investment volumes into sustainable open-end and exchange-traded funds. Flows tripled in 2019 and more than doubled in 2020 as investors reconsider their long term portfolio return profiles and the risks of climate change and non-climate friendly business models.

Core Business Functions seeing Disruption in the age of sustainability

As sustainable practices stake claim as a business imperative, below are some focus areas of our team’s sustainability thesis (although we welcome the opportunity to meet founders tackling all angles of this ecosystem). What we look for are high-growth companies disrupting their markets in innovative ways, such as the players listed here…

- Energy: Sealed, So Energy, Arcadia

- Supply Chain: Algramo, Higg, Zero Grocery

- Packaging: Ranpak, Vericool, Better Packaging

- Textiles/Raw Materials: Bolt Threads, Ecovative, read more here…

- Transportation and Logistics: Super73, Zoomo, Onto

- ESG Tracking/Traceability: Eon, Watershed, Circulor

- Carbon Emissions: Climeworks, Running Tide

- Recycling/Waste Management: Recycle Track Systems, Terracycle

The Bottom Line: Sustainable investing finally runs parallel with maximizing shareholder value

Consumers, shareholders, governments, and corporations finally have aligned interests, propelling the accelerated growth of green businesses. That is not to say that a Company is fit to deliver outsized returns purely based on ESG initiatives. Part of considering a sustainability investment equal to any other kind of investing, is recognizing that it must be held to the same standards of offering unique value to a large TAM segment with unit economics that support rapid, capital efficient growth. We believe with such meaningful market opportunity, there will be many companies who fit this example, and are excited for sustainability to continue to naturally integrated into our portfolio and the growth equity world, like players such as Super73 and Recycle Track Systems have already done.