By Jim Ferry

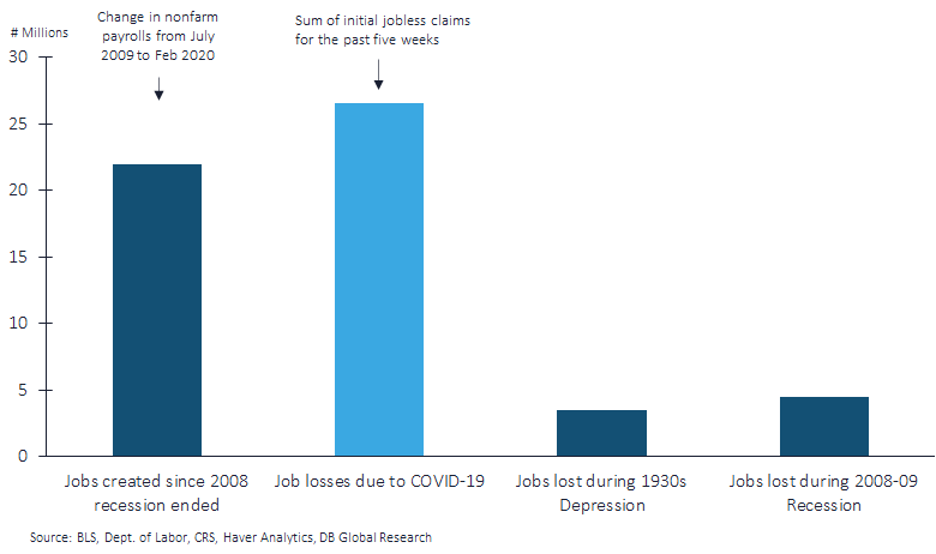

As of April 24th, unemployment in the US topped 26 million workers seeking benefits as shutdowns due to COVID-19 continue to wreak havoc on the workforce. This is ~12%+ of the workforce filing for unemployment, which is a stark contrast to the 3.5% in February 2020 prior to the pandemic, and more job cuts are likely. To put this into perspective the peak unemployment rate stemming from the 2008 financial crisis was 9.9%1. Over the last five weeks, more US jobs have been lost due to COVID-19 than were created since the 2008 financial crisis.

Government Intervention

The government has intervened in an attempt to save the unemployment claims from free falling with an initial $349B forgivable loan Paycheck Protection Program (PPP) intended to help small businesses pay their employees during the COVID-19 pandemic. However, due to a loophole in the bill millions of dollars went to large corporations and publicly traded companies that may have had enough working capital to cover employee salaries and caused the funds to dry up in under two weeks. Congress recently approved an additional $310B in funds with improved language to ensure the funds reach small businesses. This should assist some of the industries that have been hit the hardest including the restaurant industry that encompasses 10% of the overall workforce, with 70% of restaurants being single-unit operations2.

Other industries that have been hit hard by the pandemic include retail, transportation, and travel. All of these sectors have large blue collar workforces, that unlike most white collar jobs, are unable to work from home. In addition, these industries are comprised of lower-salary hourly workers that are the least financially secure given many jobs are part-time or pay low wages. Volition’s Consumer Sentiment Study reflects this with over 61% of those that were let go or furloughed had personal income levels below $50K, which is below the 2018 Census median household income level of $63K.

A Decline in Discretionary Spending

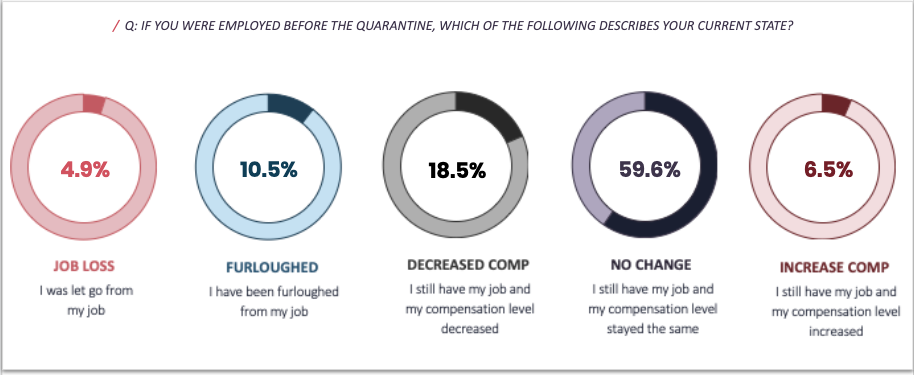

However, things may be bleaker than the unemployment figures appear. Volition’s Consumer Sentiment Study results as of April 18th, indicate that 34% of previously employed workers were either furloughed, let go, or had their compensation decreased.

The additional 19% of workers that still have their job but had their compensation decreased is not reflected in any of the unemployment figures. This potentially has profound impacts as it relates to consumer discretionary spending as ~60M+ Americans will be facing lower income levels. Even for the 66% of workers who still have their job with compensation levels staying the same or increasing, 55% of working respondents indicated that they are unable to work effectively from home which means the economy is less productive.

A U-Shaped Recovery

40% of respondents expect their discretionary spend to decrease once the quarantine is over. These discretionary categories include automotive, household durable goods, leisure equipment, textiles and apparel, hotels, restaurants, and consumer retailing and services that will all likely experience a decline in consumer spending. This spending trend contradicts a popular thesis that when the economy reopens there will be a V-shaped recovery. Despite 11% of the respondents in the workforce being furloughed, 25% of Americans fear they will lose their jobs due to COVID-193. This will lead to a larger portion of the population decreasing their discretionary spending due to tightening budgets over time.

In order to have a V-shaped recovery, the economy would need to reopen in a short period of time. It is becoming more likely that a staggered approach will be taken until there is a vaccine. With 32% of respondents unlikely to attend a large group event until 2021 or beyond, this will continue to put pressure on many of the blue collar industries that have already been hit hard and will most likely result in more job cuts. Perhaps the most telling statistic is 80% of respondents believe a second wave of COVID-19 is coming later in 2020. All of this supports the theory that we are more likely to experience a longer lasting U-shaped economic recovery.

As Volition continues to navigate these turbulent waters, we are searching for categories that will not be as negatively impacted. Essential spending categories such as groceries and other consumables, or internet-enabled services that have seen an uptick in adoption may be shielded from this impact. For example, 22% of respondents tried grocery delivery for the first time in quarantine. Other areas of interest include companies that enable the stay-at-home economy such as media and content publishers, discount ecommerce, and remote services such as telehealth. While we hope the economy will reopen and return to normalcy soon, it seems that there may be worse times before things get better.

Source:

- Labor Department

- National Restaurant Association

- Gallup

Sign up to get Volition Viewpoints in your inbox:

Meet the Author:

JIM FERRY

Vice President

Jim joined the team at Volition in 2014 and is responsible for evaluating and executing new investment opportunities in transactional Internet applications and assisting with current portfolio operations.

Connect with Jim:

tel. +1 617 830 2112

Jim@VolitionCapital.com

LinkedIn