Evolution In Consumer Banking Trends

With the $84 trillion wealth transfer underway between Boomers and Millennials, dubbed the “Great Wealth Transfer,” the banking industry faces increased pressure for more digital, transparent, and personalized experiences. 84% of Millennials are more loyal to a brand if they feel it’s transparent, and this loyalty increases with personalized communication.

In preparation for this shift, digital banking and omnichannel access are now a “must-have,” driving new account creation and accessibility. However, a critical disconnect still exists between acquiring a new account and creating an active financial institution member.

Inactive Accounts are a Drain on Financial Institution Resources

Member acquisition can cost over $400, but 25% of consumers churn within the first year. Americans are more likely than ever to have relationships with several different banks. Yet, banks and credit unions must achieve primacy to reach account profitability, requiring direct deposits, eStatements, primary card automatic payments, and cross-sell success.

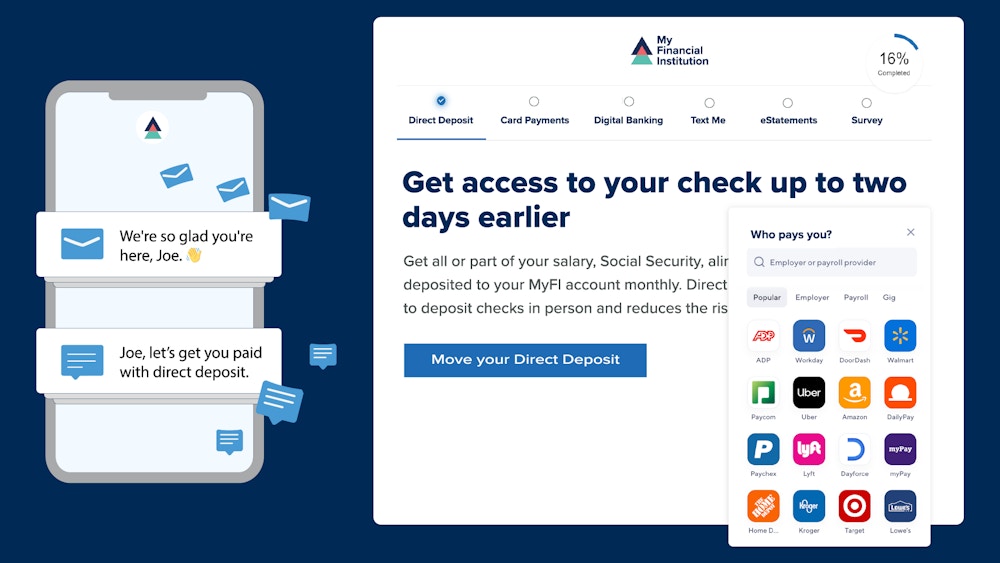

Today, many local banks and credit unions still rely on analog calling, in-branch interactions, and broad-based email, and paper-mail marketing to engage with members. When leveraging digital channels, there is still a 60% abandonment rate of cross-sell applications started, driven by friction between outreach, system log-in, and portal navigation. For banks across the country, a frictionless customer journey is a top initiative to bridge the gap from account origination to true account activation.

Enter Digital Onboarding

We are thrilled to announce a $58M growth investment in Digital Onboarding, a customer engagement solution for banks and credit unions to drive fully engaged, profitable relationships.

Digital Onboarding is uniquely positioned in its market segment. CEO Ted Brown, an industry veteran, saw first-hand a gap between digital banking portals, broad-based top-of-the-funnel marketing platforms, and account opening tools.

Customers benefit from the clear ROI of Digital Onboarding’s journey-based campaigns, which bring highly personalized experiences to members online. A fully engaged member can produce a yearly incremental profit of around $200.

The Company has achieved strong product-market fit, with a unique combination of high retention and efficient sales spend in part driven by its large referral customer base. As a capital-efficient, founder-led business, Digital Onboarding embodies the key values of a Volition investment partnership.

We are proud to back the Digital Onboarding team as it continues delighting its financial institution customers and accelerates its product roadmap through our investment.

-Sean, Melanie, Estelle, and Wells