Will The Travel Industry Bounce Back?

On September 18th, President Joe Biden appeared on CBS’s “60 Minutes” and shared a strong statement in his interview: “The pandemic is over.” Public reaction varied; some labeled this declaration insensitive considering the number of COVID-19 cases in the country, others received this message as a reminder that we’ve come a long way since the first case of COVID-19 was identified in January 2020. In the spring of 2020, as the world shut down, travel companies braced for the worst knowing that strict regulations to contain the virus meant their customer base would dwindle. As new vaccines were introduced and airlines prioritized rigid cleaning procedures to minimize exposure risk, a wave of optimism surged in the travel world—one that was short-lived as COVID-19 variants sparked new fears for travelers. As the world reacted to variants and restrictions lessened once again, 2022 served as a transition year for travel, up from the dips in 2021, but still severely limited by customer confidence, prices, and staff shortages. As we wrap up 2022, we predict 2023 to be the strongest year of travel yet in a market dominated by legacy players that is ripe for innovation.

The Travel Industry: Reviewing our Past Projections

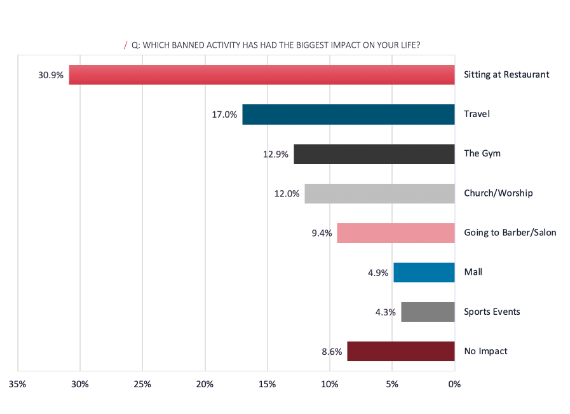

As we offer new perspectives on the future of travel, we find it useful to analyze our past expectations around the pandemic’s effect on travel. In spring 2020, we surveyed 1,000 people on which activity they missed most during quarantine, which showed travel was sorely missed—second only to the desire to dine in at restaurants. The same survey asked respondents to predict how their air travel habits after quarantine would compare to their pre-COVID travel habits, which revealed ~40% of those surveyed planned to travel less after the work from home order was lifted. From this data, we presumed travel would take a different form—with more of a focus on localized travel and experiences. To an extent, our predictions were correct with flight numbers down significantly and one billion fewer international tourists in 2020 compared to 2019, demonstrating this shift in customer behavior. Domestic air travel jumped back up to almost pre-pandemic levels much earlier than international flights, as well, and many consumers focused on local travel. Vrbo shared data to compound this point, with their local trips of 250 miles or less in July and August of 2021 increasing by 20% relative to the same summer months in 2019.[1]

Travel: Current Market Outlook

As we reevaluated this market with changing regulations leading to a more travel options, we found it necessary to restructure our thinking around this world. On June 12th, 2022, the CDC rescinded an order requiring a negative COVID-19 test for travelers flying into the U.S. Travelers started to enter in waves, and leisure travel experienced a boom this summer. JetBlue posted its first quarterly profit since the pandemic began, and many sources are highlighting the continuous rise of travel through the fall—an anomaly that calls into question the traditional seasonality this world is accustomed to.[2] United Airlines and American Airlines felt the benefits of this rising demand, with revenue in Q3 of 2022 up 66% and 50%, respectively, from the same period last year. CEO of United Airlines, Scott Kirby, noted that this past September represented the third strongest month in history for the airline. Considering September is traditionally considered an off-peak period following months of summer vacations, this statement shines a light on the magnitude of this strong demand from travelers.[3]

Unfortunately for consumers, travel remains dominated by legacy players across several categories. The travel slowdown wiped out many younger companies shaking up this industry, leaving only the larger names with the budgets to survive the 50% reduction seen in total travel and tourism spending worldwide.[4] The top online travel agencies, such as Expedia and Booking.com, have the budget to win the SEO battle for consumers. Apart from Airbnb and Vrbo becoming household names in the past decade, this case rings true with legacy hotels and accommodations as well. Despite travel’s reemergence after the peak of the COVID-19 pandemic, many of the same pain points customers experience remain present in today’s environment, and shifting customer behavior opens doors for young companies to respond to new desires and habits around travel.

Where do we see opportunities in the travel industry?

Social-Driven Travel:

As all consumer-facing brands know, winning over consumers nowadays requires marketing efforts on all fronts—especially on social media. The largest online travel agencies currently spend billions of marketing dollars to dominate the online travel booking space. Booking, Expedia, and Airbnb combined to spend about $8.5 billion on marketing expenses in 2021, more than the rest of the top 10 OTA budgets combined.[5] Rather than compete on Google AdWords against these unmatchable budgets, smaller players must get creative on how to gain visibility in this market.

New research is showing a growing usage of social media as a primary travel inspiration tool. A study from Arriva showed that almost a third of all travelers utilize social media as an inspiration tool when booking travel.[6] This pull to social is bigger in younger demographics, with a report from the Morning Consult sharing that 38% of all adults who expected to travel in the summer of 2021 use social media to plan their trips and around 50% of Gen Z adults and millennials follow a travel influencer on social media.[7] This uptick in social media usage around traveling opens an opportunity for companies to invest more in their social media efforts and get creative on how to win over these customers.

One greenfield opportunity presents itself by reaching audiences through travel influencers on social media. Companies that can lower their customer acquisition costs by redirecting marketing budgets towards utilizing this community stand to win a key traveler demographic—and avoid SEO spending battles with the sizable marketing budgets of online travel agencies. These online travel agencies, among other legacy incumbents in the travel industry, have not prioritized their social media efforts. Google Senior Vice President, Prabhakar Raghavan, shared their internal studies found that almost 40% of young people go to TikTok or Instagram when searching for a place for lunch. Quick, bite-sized video recommendations on TikTok appeal to this younger consumer, and the same effect will apply to travel recommendation videos across these channels.[8] As legacy incumbents prioritize their energy and budgets on winning across Google Ads and SEO, they fail to adjust to behavioral shifts from consumers and will struggle to catch up.

Rebounding Travel Across Customer Demographics:

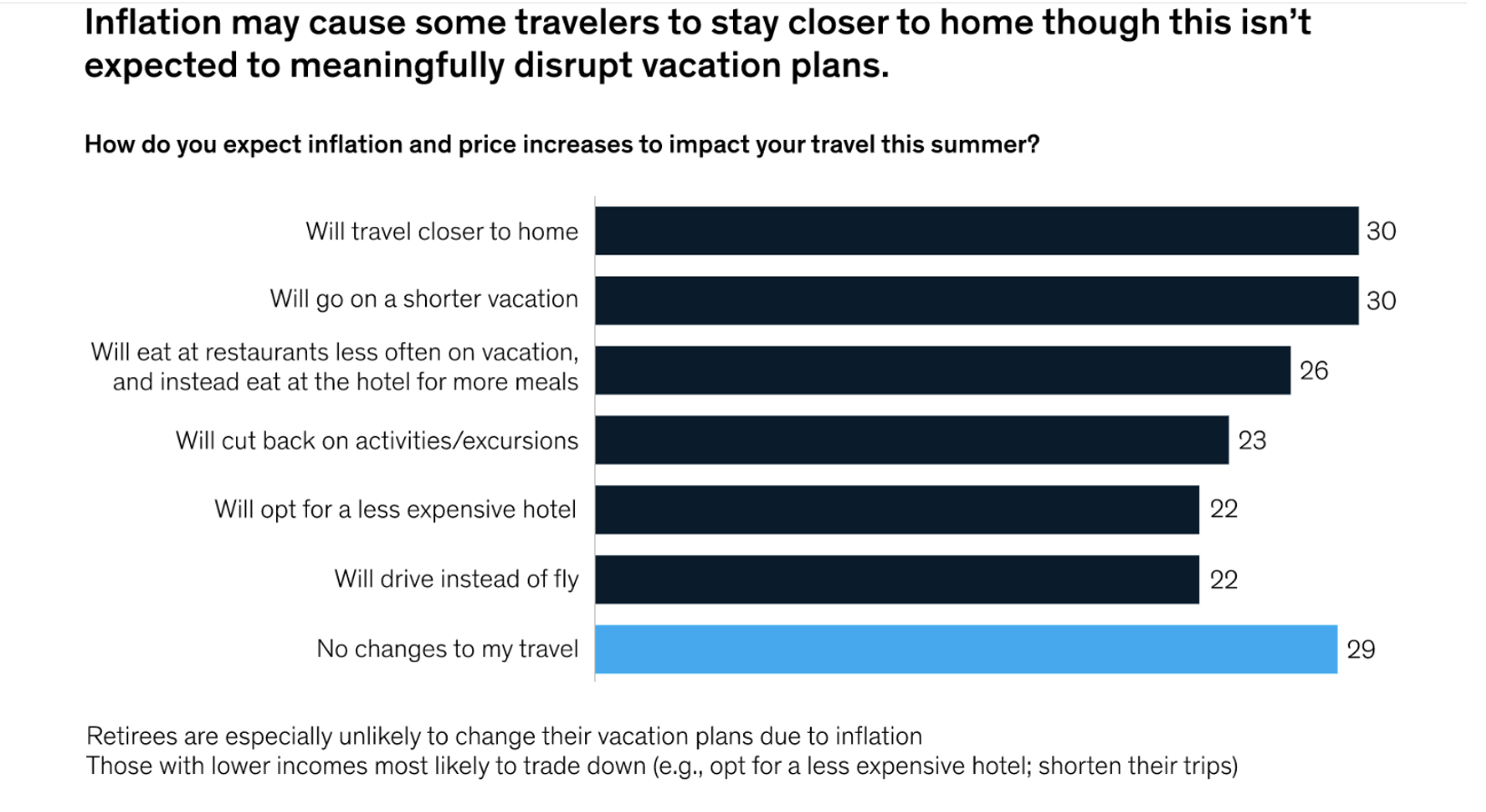

We theorize that travel should see a significant increase across financial customer demographics as customers seek experiential locations with pent-up demand from the travel restrictions over the past two years. Travel research out of McKinsey reveals that, despite recessionary fears and price increases due to inflation, consumers are sticking to their travel plans—only making slight adjustments to shorten trips or find closer destinations. The company’s U.S. traveler survey from June 2022 questions how price increases will impact summer travel plans—and the chart below verifies many expect little to no changes to their trips.[9]

Although luxury trips are hyper-personalized and represent a small number of customers, the luxury sector spent $363 billion on travel in 2019 and, on average, the American luxury traveler spends almost double the average U.S. traveler.[10] An American Express poll conducted in 2021 reveals that 61% of travelers plan to spend more than usual on trips to account for abandoned travel plans in 2020.[11] This desire is paired with a global savings increase—households have saved $5.4 trillion more than their expected average levels of savings.[12] Again, focusing on the luxury segment provides even more optimism: The richest 40% of Americans hold almost two-thirds of the more than $2 trillion in U.S. household savings above the normal trend, according to a report out of Goldman Sachs. In light of the strong US dollar, American consumers may feel more drawn to international travel knowing that that dining and shopping across the globe feel more affordable. This capital will be used—and innovative travel companies that can appeal to this sector, through the inspiration, booking, or experiential parts of trips, are set to grow significantly.

Travel companies are increasingly aware of this savings budget across financial demographics and the desire to travel that accompanies it, focusing on building ancillary offerings to service these customers. Airlines are taking notice of steady spending on premium air travel, with many players like Delta and British Airways investing to add premium economy cabins to their aircraft to profit from eager travelers with the budget to splurge on comfort for longer international flights.[13] Additionally, the emergence of various solutions, like layaway or cancellation insurance, allows for more spontaneous travel plans and flexibility for all travelers. In fact, Hopper, a large Canadian online travel agency, revealed that travelers are willing to spend an added $40 on their trips for flexibility and the peace of mind it brings, based on a study of their users.[14] With luxury travel’s rebound, airlines adjusting for more categories of travelers, and a global pent-up demand, vacation activities and accommodations will receive unprecedented spend in the coming years.

The End of Traditional Seasonality in Travel:

The growing digitization and flexibility of the workplace have resulted in a convergence of business and leisure travel. As remote and hybrid work options become increasingly necessary for companies to retain talent, a significant opportunity appears for travel companies through the elimination of stricter vacation windows and the growth of business trips-turned-vacations. This flexibility grants workers the freedom to take more impromptu weekend trips, but mainly it results in the growth of long-term stays—which were at an all-time high on Airbnb in Q1 2022.[15] During this same quarter, Airbnb reported almost half of all trips booked lasted at least a week. A travel report out of Deloitte defined a working traveler demographic, “laptop-luggers”, that is adding several days to their leisure trips knowing they can work remotely from their vacation spot.[16] As corporate travel rebounds, young companies can take advantage of longer trips and offsite team travel, while keeping an eye on new opportunities in light of more flexible work environments across the globe.

Despite recessionary fears, travel will continue to boom in the coming years as various consumer profiles prioritize trips that fulfill their pent-up travel desires. Rather than competing against the enormous budgets of incumbents in this industry, we see unique opportunities for younger companies to find value in luxury travel, social media, and the shifting nature of corporate trips.

About the Author

MATTEO PALACARDO

matteop@volitioncapital.com

Matteo is an Analyst on the Internet & Consumer team. He is responsible for sourcing and evaluating new investment opportunities in transactional Internet and consumer product companies.

Prior Experience & Education

- Matteo graduated from the McDonough School of Business at Georgetown University with a double major in Finance and Marketing

- He served as CEO of Georgetown Ventures, the university’s undergraduate entrepreneurship club that operates as a startup incubator and accelerator

- In 2021, his team of Georgetown undergraduates won the global championship for the Undergraduate Venture Capital Investment Competition

- Throughout his college career, he explored countless industries with various roles such as a Marketing Intern for Nutella, an Operations Intern for FENDI, and a consultant for a startup advisory firm, before finding his passion for venture capital with TDF Ventures, an early-stage VC in Washington, D.C.

References:

[1] Vrbo

[2] Wall Street Journal

[3] LinkedIn

[4] Statista

[5] Statista

[6] Arriva

[7] The Morning Consult

[8] The New York Times

[9] McKinsey & Company

[10] Skift

[11] American Express

[12] Goldman Sachs

[13] Skift

[14] Skift

[15] Airbnb

[16] Deloitte